You can add or deduct specific dollar amounts from payments, even when such additions/deductions have nothing to do with specific claim counts. For example, if a special IRS withholding situation occurs, you may need to deduct a certain amount of money from a provider's payment each time you issue it.

Note: Do not confuse these non-claim payment adjustments with adjustments made to specific claims. For more information about claim adjustments, see Change/Adjust Claims.

To create a non-claim payment adjustment:

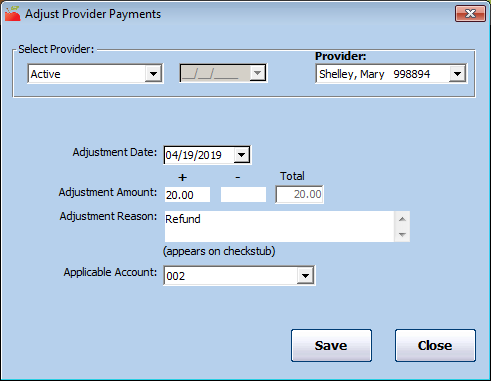

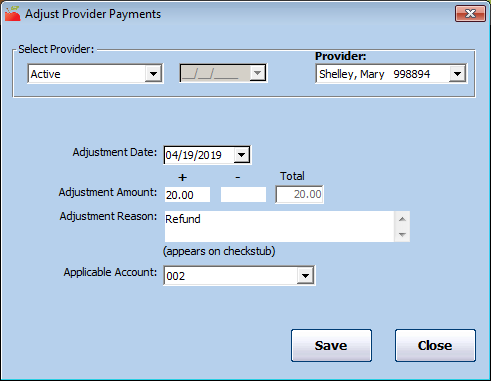

- Click the Checkbook menu and select Adjust Provider Payments. The Adjust Provider Payments window opens.

- Click the Provider drop-down menu and select the provider for whom to adjust payments.

- Click the Adjustment Date box and enter the effective date of this adjustment. This box defaults to today's date.

- Enter the adjustment amount in the + (plus) or - (minus) boxes. The Total box updates automatically.

- Click the Adjustment Reason box and enter the reason for this adjustment. This prints on the provider's check/payment voucher.

- Click the Applicable Account drop-down menu and select the adjustment account code. This code impacts transaction export files. This field only displays if you are required to select an adjustment account code.

- Click Save.

The next time you issue payments, be sure to check the Include Non-Claim Payment Adjustments box so this adjustment is automatically included in the provider's next payment. For more information, see Issue Payments.